Moniepoint: App, Login, ATM, Agent, POS, Loan & Care in 2023

Master Moniepoint in a snap! Learn the Moniepoint App, Login at atm.moniepoint.com, Agent Registration, Moniepoint POS, Loan & Customer Care.

Welcome to your essential guide to navigating Moniepoint, a game-changer in Nigeria’s financial landscape. Born in 2019 from the innovative fintech company TeamApt Inc., now called Moniepoint Inc., Moniepoint has swiftly carved a name for itself as one of Nigeria’s largest mobile money platforms.

This guide is your ticket to unlocking the full potential of Moniepoint through the Moniepoint App, the Moniepoint Login Website, and the Moniepoint Registration Website at atm.moniepoint.com. It doesn’t matter if you’re a first-time visitor or a seasoned user; here, you’ll find valuable tips and insights.

Looking to become a Moniepoint Agent? We’ve got you covered. Interested in hassle-free transactions at the ATM, via the Moniepoint POS, or getting a Loan with a BVN and NIN? You’re in the right place. With Moniepoint, accessing and providing financial services has never been simpler.

And remember, if you need any assistance, the Moniepoint Customer Care team is always ready to help. So let’s dive in and transform you into a Moniepoint expert!

Table of Contents

Understanding Moniepoint

Before we dive into the nuts and bolts, let’s take a moment to understand what Moniepoint is and who is behind it. Is it like a traditional Nigerian Bank?

What is Moniepoint?

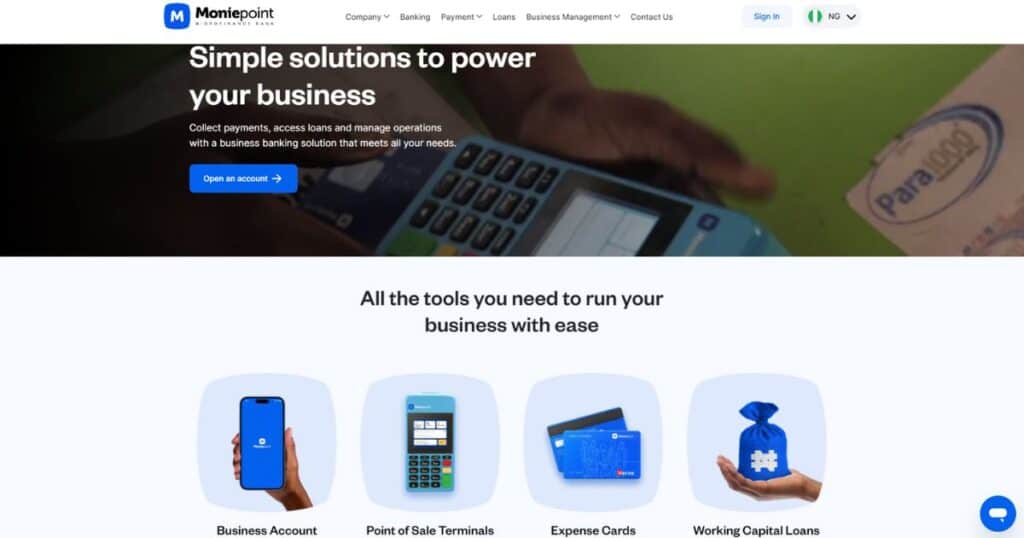

Moniepoint, a Nigerian fintech firm, provides business banking services and payment solutions. Starting as an agency banking improvement tool, it’s evolved into a comprehensive banking platform, introducing products like Monnify and the Moniepoint POS for quick, smooth transactions.

Who Owns Moniepoint?

Moniepoint is owned by Moniepoint Inc., previously known as TeamApt Inc. The company was founded by a team of ex-Interswitch engineers and has grown into a global entity with over a thousand team members spanning more than seven countries.

Is Moniepoint a Bank?

While Moniepoint started as a payment platform and financial solutions provider, it has expanded its services and obtained a banking license from the Central Bank of Nigeria (CBN). It launched Moniepoint Microfinance Bank in 2022, offering bank accounts, loans, and payment tools, qualifying it as a banking entity.

Getting Started and Moniepoint Login

Now that we’ve covered the basics let’s get you started on how to use Moniepoint.

Moniepoint Login

To log in to your Moniepoint account, visit the Moniepoint Website or open the Moniepoint App on Google Play or Apple App Store. Input your registered email address or phone number along with your password. If you’ve forgotten your password, don’t worry. Use the “Forgot Password” option to reset it; you’ll be back soon.

Requirements to open a Business Account on Moniepoint

- Gather Personal Information: Ensure you have a functional phone number and an easily accessible email address.

- Obtain a Valid ID and Details: Prepare your Bank Verification Number (BVN) and any valid government ID like an International Passport, Driver’s License, Permanent Voter’s Card, or National Identification Number (NIN). Foreigners should have their Residence/Work Permit ready.

- Proof of Address: A utility bill is typically acceptable for this requirement.

How to Open a Moniepoint Account at atm.moniepoint.com?

- Go to the Moniepoint website at atm.moniepoint.com or download the app.

- Tap ‘Register’ or ‘Sign Up. Input your name, email, phone number, and a secure password.

- Verify your account using the code sent to your email or phone, and then verify your BVN.

- After verifications, choose a username and password to complete your Moniepoint profile.

- Once created, submit or upload any required documents for KYC (Know Your Customer).

Understanding Your Moniepoint Account Number

Upon successful registration, you will be assigned a unique Moniepoint account number. This number is vital for transactions like fund transfers. Keep it safe and secure!

Moniepoint Fees

Moniepoint charges nominal transaction fees to keep the platform operational and provide quality service. Fees may vary depending on the transaction type, so always check the fee structure detailed in the app or website.

Navigating the Moniepoint App

How to Download the Moniepoint App?

To harness the full potential of Moniepoint, you’ll want to have their mobile app handy. Here’s how you can download it:

- Open your app store (Google Play Store for Android users and Apple App Store for iOS users).

- Type “Moniepoint” into the search bar and hit search.

- Click on the app from the search results and tap ‘Install’ or ‘Get.’

- Wait for the app to download and install. Once done, open the app, and you’re good to go!

How to Use the Moniepoint App?

The Moniepoint app is user-friendly and easy to navigate. You’ll find various services on the home screen when you open the app. To use a service, tap on it and follow the on-screen prompts. If you ever feel lost or confused, the ‘Help’ section in the app is there for your rescue.

Understanding Your Moniepoint Dashboard

The Moniepoint dashboard is the first thing you see when you log into your account. It displays your balance, recent transactions, and quick links to common services such as transfers, airtime purchases, and bill payments. Spend time familiarizing yourself with the dashboard to make your Moniepoint experience seamless.

Transacting with Moniepoint

How to Use the Moniepoint USSD Code?

The Moniepoint USSD code, *888#, provides a quick and easy way to perform transactions even without internet access. Dial *888# and follow the prompts to access services such as transfers, bill payments, and more.

How to Transfer Money to a Moniepoint Account?

To transfer money to a Moniepoint account:

- Log into your Moniepoint account.

- Select ‘Transfer’ from the dashboard.

- Input the recipient’s account number and select ‘Moniepoint’ as the bank.

- Confirm the recipient’s details, input the amount, and complete the transaction.

How Much a Moniepoint Account Can Hold without BVN?

A Moniepoint account without a verified Bank Verification Number (BVN) has a maximum balance limit of N300,000. You must provide your BVN and complete the verification process to increase this limit.

How to get a Moniepoint Expense Card?

To acquire a Moniepoint expense card, follow these steps:

- Log into your Moniepoint account, select ‘Cards’ from your dashboard, then click ‘Request for card’.

- Choose a card type that suits your business and assign the card to a staff member.

- Give the card a specific name related to its function, and fill in your preferred delivery information.

- Assign a debit account for the expense card funds and pay the necessary fees by funding your business wallet with at least N1,500.

- Review all the details and await your expense card delivery within 48 hours. This card will help you manage and track your business expenses effectively.

How to block Expense Card

How to unblock Expense Card

Moniepoint Loans and ATM

How to Borrow Money from Moniepoint for a Loan?

Moniepoint provides quick loans to users in need of emergency funds. To apply for a loan:

- Log into your Moniepoint account and navigate to ‘overdrafts’ from the dashboard (top left).

- If you are eligible, follow the prompts, fill out the loan application form, and submit it.

- You’ll receive the loan amount directly in your Moniepoint account if your application is approved.

Understanding the Moniepoint Loan Code

Moniepoint also provides loans via the Moniepoint USSD code, also called the Moniepoint Loan Code, similar to the USSD code to check your NIN. Dial *888#, select ‘Loans,’ and follow the prompts to apply. Remember, it’s important to understand the loan terms before applying.

Moniepoint ATM

Moniepoint offers ATM services via its agent network. If you need to withdraw cash, locate a Moniepoint agent near you, provide your account details, and withdraw cash seamlessly.

How to Become a Moniepoint Agent?

Being a Moniepoint agent offers a unique opportunity to earn while providing essential financial services to your community. Here’s how you can become an agent:

How to Become a Mobile Money Agent?

- Partner Choice: Consider transaction fees, approval criteria, and starting capital when picking a company.

- Work Commitment: Understanding success requires dedication and strategic planning.

- Location Choice: Opt for an area with high business activities but limited banking facilities.

- Service Selection: Choose and perfect financial tasks that attract the most clients and revenue.

- Customer Acquisition: Use prominent branding and adverts to publicize your business.

Remember, growth may necessitate hiring additional agents and establishing strong community relations. Strive for fast, reliable service to build trust and expand your clientele.

Moniepoint Agent Registration

- Visit the official Moniepoint website and navigate to the “Become an Agent” section.

- Fill in the agent registration form with your accurate details.

- Upload the required documents, such as proof of identity and address.

- Upon completion, submit your application and await feedback from Moniepoint.

Moniepoint Agent Login

After successful registration, you can log in to your agent account through the Moniepoint Agent App or Moniepoint Agent Login Website by entering your registered phone number and password.

Moniepoint Agent App

The Moniepoint Agent App is a must-have for agents. It provides a seamless way to manage your agent operations, including transaction history, customer management, etc. You can download it from your device’s app store.

POS Services from Moniepoint POS

Moniepoint offers reliable Moniepoint POS Services that make transactions swift and effortless.

How to Get a Moniepoint POS

To get a Moniepoint POS, follow these steps:

- Request POS: Sign into your account, choose your business, and select “Request New POS”.

- Select Terminal: Pick the MP35P Smart POS terminal. The total cost is N21,500, covering various fees.

- Delivery Details: Fill in the desired delivery address.

- Pay: Deposit a minimum of N21,500 into your Business Account and make the payment.

- Get Support: A dedicated Relationship Manager will deliver your POS within 48 hours and provide training.

The Price of a Moniepoint POS Machine

The price of a Moniepoint POS machine varies and is subject to change. It’s recommended to confirm the current price from Moniepoint’s official channels.

Customer Support at Moniepoint

Having issues or questions? Moniepoint customer support is here to help.

Moniepoint Customer Care Number and Email

You can get customer care at the Moniepoint Website Contact. Here you can Submit An Issue or chat live with a customer representative. You can get answers by visiting the Moniepoint Help Center on the website.

- Moniepoint Email for Support: support@moniepoint.com

- Moniepoint Email for Information: info@moniepoint.com

- Moniepoint Login: atm.moniepoint.com

How to Make a Complaint to Moniepoint

To complain:

- Open your Moniepoint App and tap ‘Help’ or ‘Support.’

- Click ‘Contact Us’ or ‘Report an Issue.’

- Describe your issue in detail and submit your complaint. A representative should reach out to you within a reasonable timeframe.

Troubleshooting Moniepoint

Moniepoint offers a user-friendly interface. However, there could be occasions when you encounter issues. Here’s what to do:

How to Unlock Your Moniepoint Account

If you’ve been locked out of your account due to incorrect password attempts or security reasons, contact Moniepoint’s customer care line or email their support team. They will guide you through the process of unlocking your account.

How to Delete Your Moniepoint Account

Contact the customer service team if you decide to close your Moniepoint account. Remember, this action is irreversible, and you should consider it carefully before proceeding.

FAQs on Moniepoint

Conclusion

We hope this guide helps you confidently navigate Moniepoint and its vast financial services.

From seamless Moniepoint Login at atm.moniepoint.com, and Moniepoint Agent Login, to mastering the dynamic Moniepoint App and Moniepoint POS, you’re now fully well-equipped to control your financial transactions fully.

Are you considering becoming a Moniepoint Agent? With the knowledge gained from this guide, you’re one step closer to bridging the gap between financial services and underserved communities.

Remember, the Moniepoint journey is one of empowerment and inclusion. It’s time to leverage this platform to simplify your financial needs and those of others around you. Stay financially savvy!

DecodeNaija Blog

If you’re looking for more ideas like this, then be sure to read our blog at DecodeNaija.

Here you’ll find even more guides to help you get started with ideas and hacks on business, finance, and lifestyle, like our article on How to Make Money with AI and ChatGPT Online in Nigeria.

So don’t wait any longer – take the plunge!

References

- “Moniepoint” Moniepoint Official Website, 2023. www.moniepoint.com

- Moniepoint Blog, 2023. www.moniepoint.com/blog